It Is Important for a Good Economic Model to Predict Cause and Effect So That It Can:

Section 01: Supply and Demand

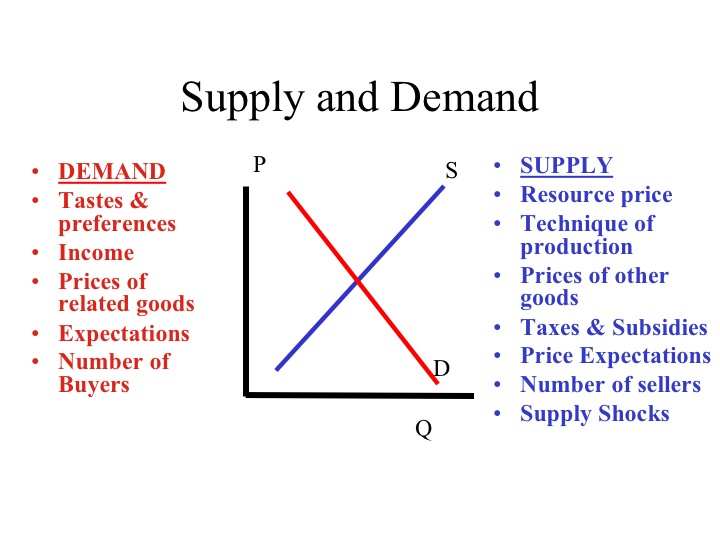

Supply and Demand

Teach a parrot the terms of 'supply and demand' and y'all've got an economist.

-- Thomas Carlyle

A market place brings together and facilitates trade between buyers and sellers of a good or services. These markets range from bartering in street markets to trades that are made through the internet with individuals around the globe that never have met face up to face.

A market consists of those individuals who are willing and able to buy the particular practiced and sellers who are willing and able to supply the good. The market brings together those who demand and supply the good to decide the price.

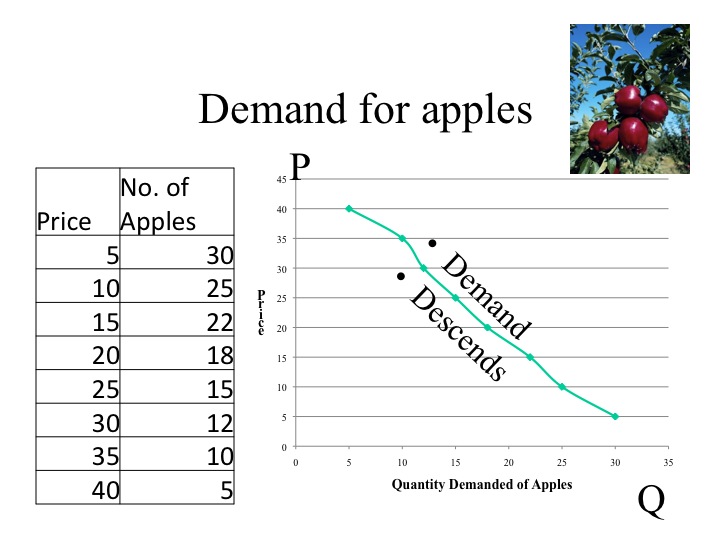

For example, the number of many apples an individual would be willing and able to buy each month depends in part on the price of apples. Bold only price changes, then at lower prices, a consumer is willing and able to purchase more than apples. Every bit the toll rises (again belongings all else constant), the quantity of apples demanded decreases. The Law of Demand captures this relationship between price and the quantity demanded of a product. It states that at that place is an inverse (or negative) human relationship between the price of a good and the quantity demanded.

Need Curve

Recall, that we correspond economical laws and theory using models; in this example nosotros tin can use a demand schedule or a demand curve to illustrate the Police of Need. The demand schedule shows the combinations of toll and quantity demanded of apples in a tabular array format. The graphical representation of the need schedule is called the demand curve.

When graphing the demand curve, price goes on the vertical centrality and quantity demanded goes on the horizontal axis. A helpful hint when labeling the axes is to remember that since P is a tall letter, it goes on the vertical centrality. Another hint when graphing the demand curve is to recollect that demand descends.

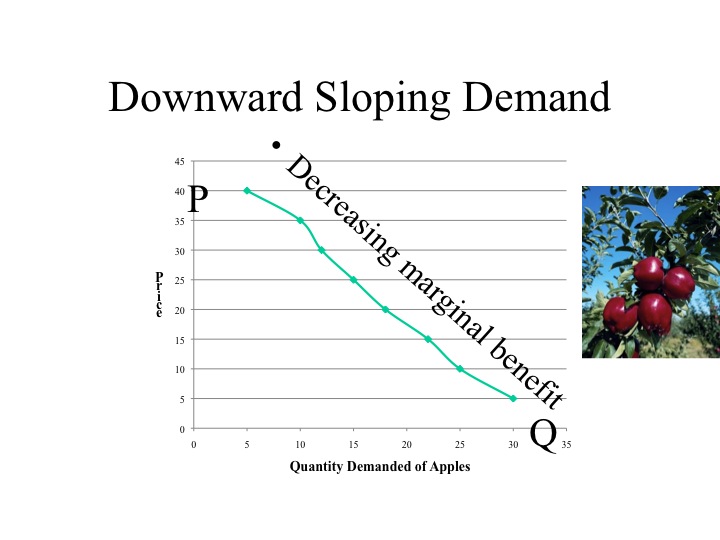

The need curve reflects our marginal benefit and thus our willingness to pay for additional amounts of a good. It makes sense that our marginal benefit, or willingness to pay for a expert, would decline as we eat boosted units because we get less boosted satisfaction from each successive unit consumed. For case, at dejeuner time you decide to buy pizza by-the-piece. Y'all'd exist willing to pay a lot for that first slice to satisfy your hunger. Only what about the second slice? Perhaps a little less. If we keep considering each additional slice, we might ask what the 3rd, quaternary or 5th piece is worth to you. By that point, you'd be willing to pay less, perhaps much less. The law of demand and our models illustrate this behavior.

A more than formal exam of the police force of demand shows the most bones reasons for the downward sloping nature of need. The first is the substitution consequence which states that as the price of the skilful declines, it becomes relatively less expensive compared to the cost of other appurtenances and thus the quantity demanded is greater at a lower price. When the cost of the good rises, the reverse occurs; that is, as the toll of the good becomes relatively more expensive compared to other goods a lower quantity will be demanded. For example, as the toll of apples increases or decreases, apples become relatively more or less expensive compared to other appurtenances, such as oranges. Thus if the price of apples declines, consumers volition purchase more apples since they are relatively less expensive compared to other goods, such as oranges.

The second factor is the income effect which states that as the toll of a good decreases, consumers get relatively richer. Now, their incomes have not increased, but their buying ability has increased due to the lower price. If they continued to buy the same amount, they would have some money left over - some of that extra money could be spent on the skilful that has the lower price, that is quantity demanded would increase. On the other mitt, every bit the price of a good increases, then the buying ability of individuals decreases and the quantity demanded decreases. For example, at 20 cents per apple, we are able to purchase v apples for $1 but if the cost falls to 10 cents, nosotros would be able to purchase 10 apples for $1. Although our income has not inverse, we accept get relatively richer.

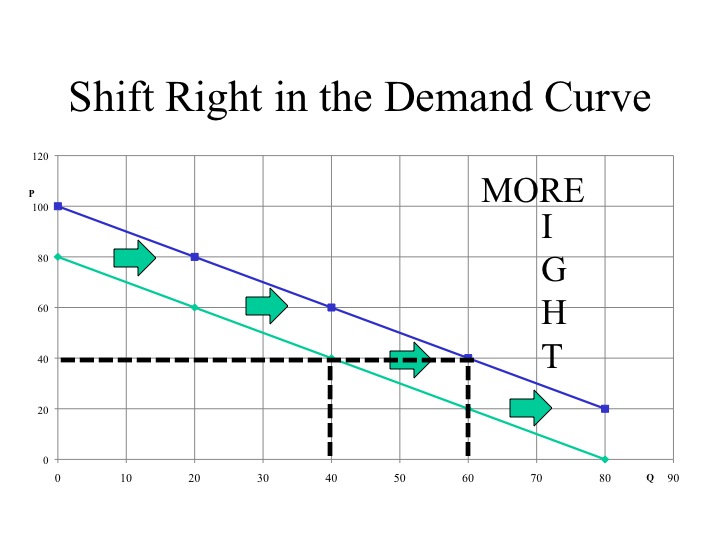

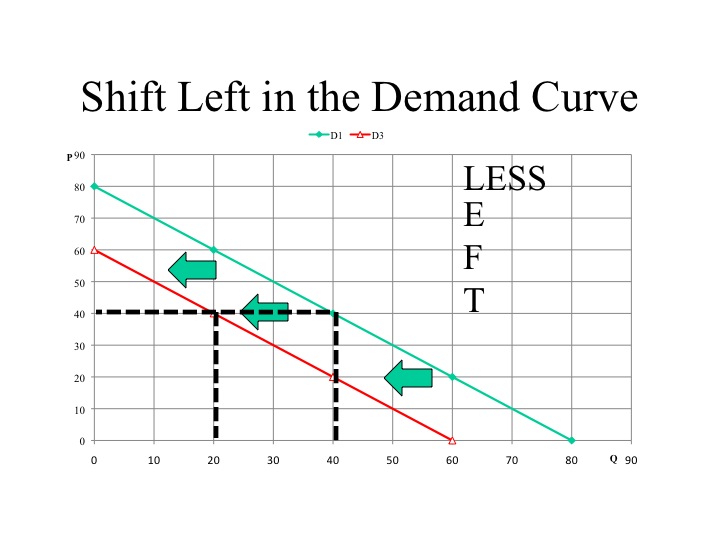

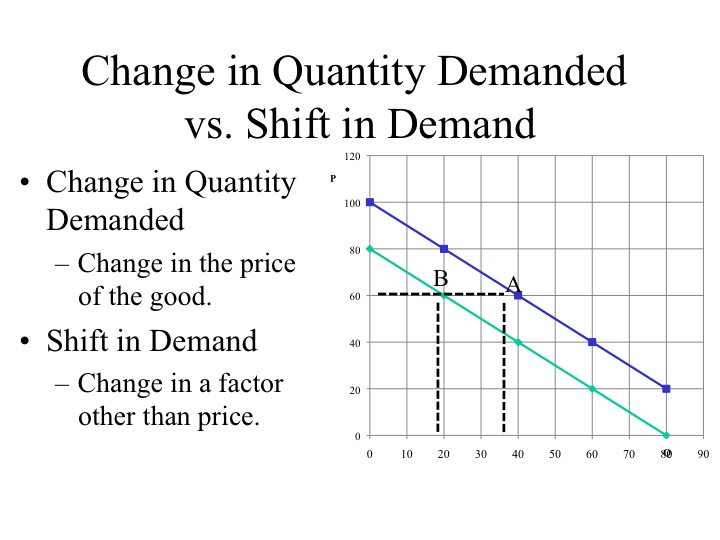

At this signal, nosotros have explained why at that place is an inverse relationship between price and quantity demanded (i.e. we've explained the constabulary of demand). The changes in price that we have discussed cause movements along the need curve, called changes in quantity demanded. But there are factors other than price that cause complete shifts in the demand curve which are chosen changes in demand (Note that these new factors too determine the bodily placement of the demand curve on a graph).

While a change in the toll of the practiced moves united states along the demand curve to a different quantity demanded, a modify or shift in demand will cause a different quantity demanded at each and every price. A rightward shift in demand would increase the quantity demanded at all prices compared to the original demand bend. For example, at a price of $forty, the quantity demanded would increment from 40 units to 60 units. A helpful hint to call up that more demand shifts the demand curve to the right.

A leftward shift in demand would decrease the quantity demanded to 20 units at the price of $40. With a subtract in demand, there is a lower quantity demanded at each an every cost along the need bend.

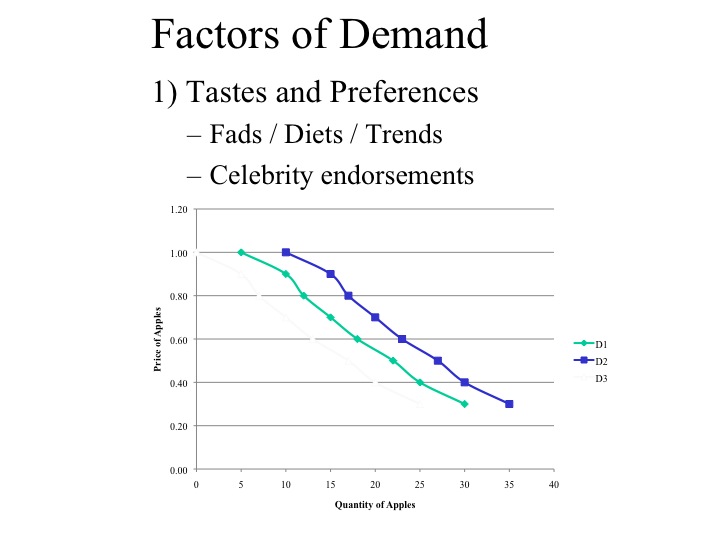

Factors of Demand

A change in tastes and preferences volition cause the demand bend to shift either to the right or left. For example, if new research institute that eating apples increases life expectancy and reduces disease, then more apples would exist purchased at each and every toll causing the demand curve to shift to the right. Companies spend billions of dollars in advertising to effort and change individuals' tastes and preferences for a product. Celebrities or sports stars are frequently hired to endorse a production to increase the demand for a production. A leftward shift in demand is caused by a cistron that adversely effects the tastes and preferences for the skillful. For example, if a pesticide used on apples is shown to have adverse wellness effects.

Another cistron that determines the demand for a adept is the price of related appurtenances. These tin be cleaved down into two categories – substitutes and complements. A substitute is something that takes the identify of the proficient. Instead of ownership an apple, ane could buy an orange. If the toll of oranges goes up, we would expect an increment in demand for apples since consumers would motion consumption away from the college priced oranges towards apples which might be considered a substitute good. Complements, on the other hand, are appurtenances that are consumed together, such as caramels and apples. If the cost for a good increases, its quantity demanded will decrease and the demand for the complements of that good volition also pass up. For case, if the price of hot dogs increases, one volition buy fewer hot dogs and therefore need fewer hot dog buns, which are complements to hot dogs.

Think that demand is made up of those who are willing and able to purchase the good at a detail price. Income influences both willingness and ability to pay. As ane'southward income increases, a person's ability to purchase a adept increases, simply she/he may not necessarily want more. If the demand for the good increases as income rises, the good is considered to be a normal skilful. Most appurtenances fall into this category; we want more cars, more TVs, more boats every bit our income increases. As our income falls, nosotros besides demand fewer of these appurtenances. Junior goods have an changed relationship with income. As income rises we demand fewer of these goods, but equally income falls we demand more of these goods. Although individual preferences influence if a good is normal or inferior, in general, Top Ramen, Mac and Cheese, and used clothing autumn into the category of an junior adept.

Another factor of demand is future expectations. This includes expectations of future prices and income. An private that is graduating at the stop of the semester, who has simply accepted a well paying task, may spend more today given the expectation of a higher future income. This is specially true if the chore offer is for more income than what he had originally predictable. If one expects the price of apples to become up next week, she will probable buy more apples today while the price is notwithstanding low.

The terminal factor of need is the number of buyers. A competitive market is made up of many buyers and many sellers. Thus a producer is non particularly concerned with the demand of one individual merely rather the need of all the buyers collectively in that market. Equally the number of buyers increases or decreases, the demand for the good will change.

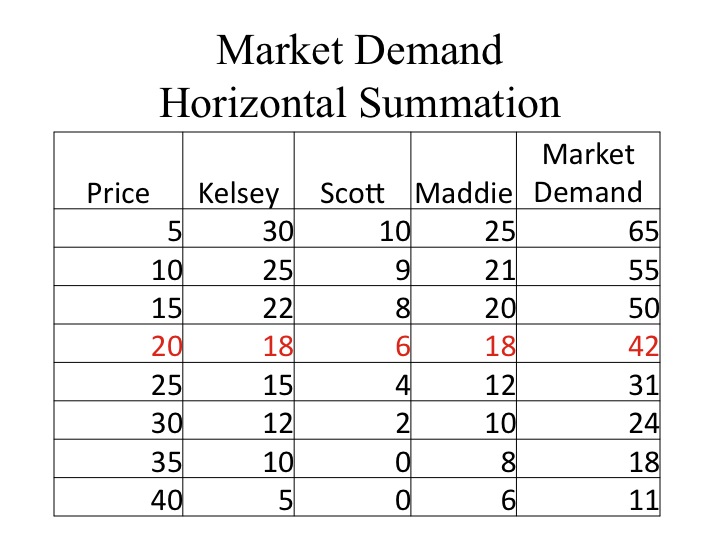

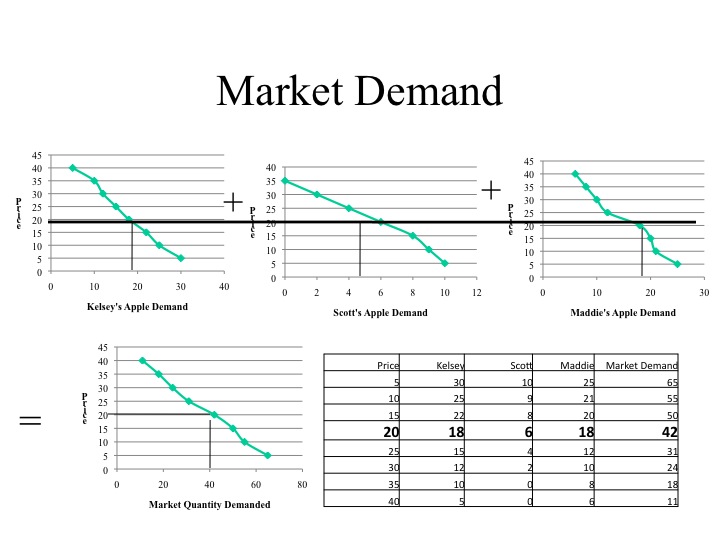

The market demand is adamant by the horizontal summation of the individual demands. For example, at 20 cents per apple, Kelsey would buy 18 apples, Scott would purchase 6 and Maddie would buy eighteen, making the market quantity demanded at xx cents equal to 42 apples.

When determining the market demand graphically, we select a price then detect the quantity demanded past each individual at that toll. To make up one's mind the unabridged demand curve, nosotros would and then select another price and repeat the process.

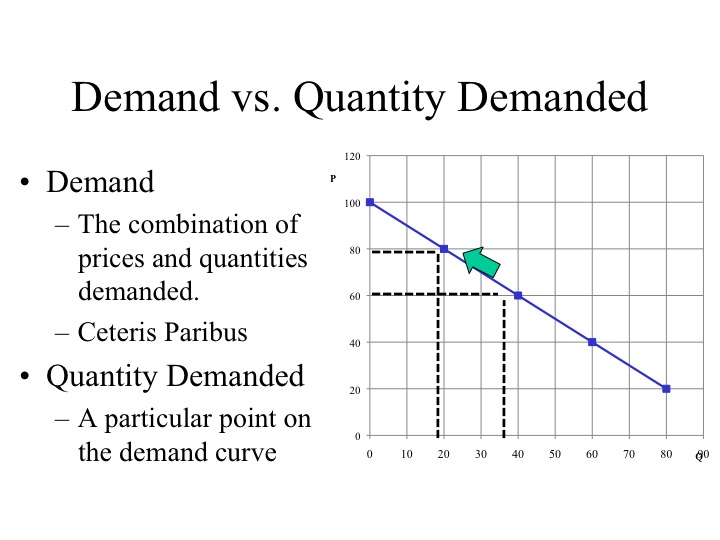

Need vs. Quantity Demanded

At this point, it is important to re-emphasize that there is an of import distinction between changes in demand and changes in quantity demanded. The entire curve showing the various combinations of cost and quantity demanded represents the demand curve. Thus a alter in the toll of the adept does not shift the curve (or modify demand) simply causes a movement along the demand curve to a different quantity demanded. If the toll returned to its original price, nosotros would return to the original quantity demanded.

If the price were originally $60, the quantity demanded would exist 40 units. An increase in the cost of the skillful to $80 decreases the quantity demanded to 20 units. This is a move along the need curve to a new quantity demanded. Note that if the price were to return to $60, the quantity demanded would besides return to the 40 units.

A shift or modify in demand comes nigh when in that location is a different quantity demanded at each price. At $60 nosotros originally demanded xl units. If there is a lower quantity demanded at each price, the demand curve has shifted left. At present at $60, there are only 20 units demanded. Shifts in demand are acquired past factors other than the toll of the good and, every bit discussed, include changes in: 1) tastes and preferences; 2) cost of related goods; 3) income; four) expectations about the future; and five) market size.

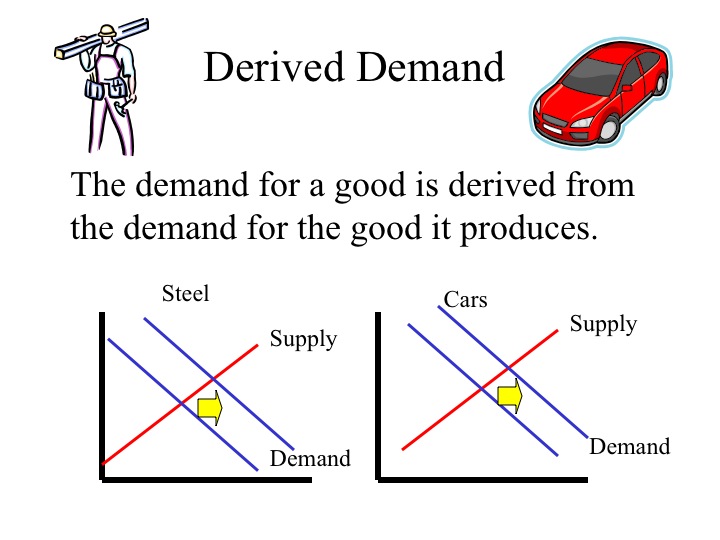

The demand for an input or resources is derived from the need for the adept or service that uses the resource. Nosotros practise not value steel in and of itself, but since we need cars, we indirectly demand steel. If the demand for cars increases, this would crusade an increment in the demand for the steel that is used to brand the cars.

Practise

Identify how each of the following would change the need (shift right, shift left, movement along).

| Market | Particular |

| 1. Oranges | A new nutrition consisting of eating six oranges a day becomes the latest diet fad. |

| 2. Cars | Consumers' income rises. |

| iii. Cars | The price of gasoline doubles. |

| 4. Gym memberships | The price of personal exercise equipment increases. |

| 5. Shoes | The number of shoe manufacturers increases. |

| 6. Arthritis medication | The number of elderly citizensincreases. |

Answers: i. D-right ii. D-correct iii. D-left 4. D-right five. Along half dozen. D-correct

Section 02: Supply

Supply

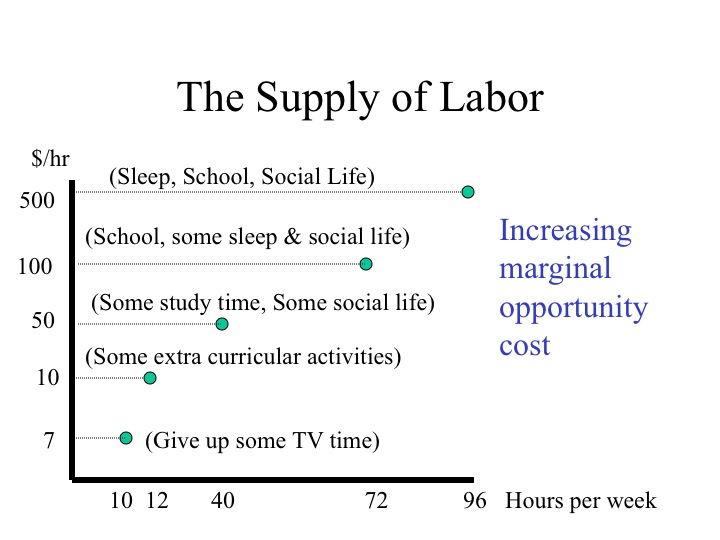

Supply shows the corporeality that producers are willing and able to supply to the marketplace at each given price. Producers must receive a toll that covers the marginal cost of production. As the toll of the adept rises, producers are willing to produce more of the good even though there is an increasing marginal toll.

If you lot were offered a job doing data entry this semester and could piece of work as many hours as yous wanted, how many hours per week would you work at minimum wage? The reply to this would be based on your opportunity cost. What would y'all take to give up – social time, written report fourth dimension, or some other job?

An individual may be willing to work a few hours at a low wage since the value of what they are sacrificing is relatively low. Every bit the wage rate rises, individuals are typically willing to work more than hours since the marginal do good becomes greater than or equal to the marginal toll of what has to be sacrificed. At some point, many students would choose to drop out of school for the semester since the marginal do good is greater than the marginal toll. Many stars and celebrities never nourish college or drop out since the income that they would be foregoing at that time in their lives, exceeds the increase in their earnings potential of attention school.

The climate and soils of Idaho allow it to abound some of the best potatoes in the world. At a given price, farmers are willing to supply a certain number of potatoes to the marketplace. Since farmers take already used their country best suited for potato production they have to use land that is less suitable to potato production if they want to grow more potatoes. Since this country is less suited for white potato production, yields are lower and the cost per hundredweight of potatoes is greater. As the price of potatoes increases, farmers are able to justify growing more than potatoes even though the marginal cost is greater.

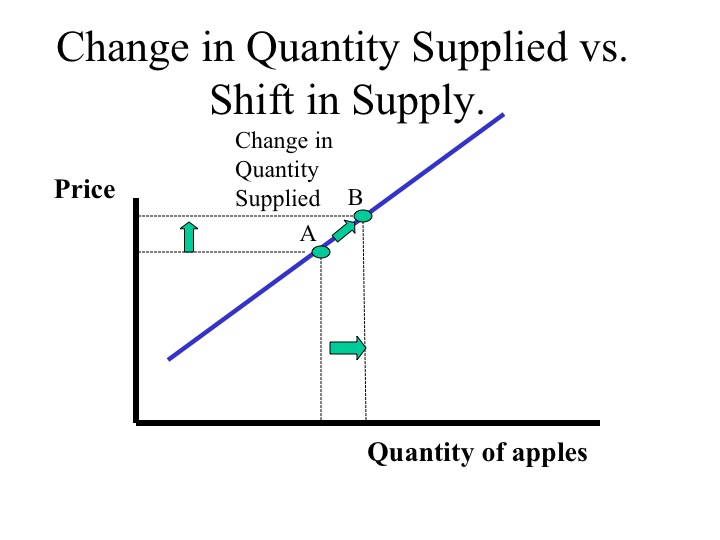

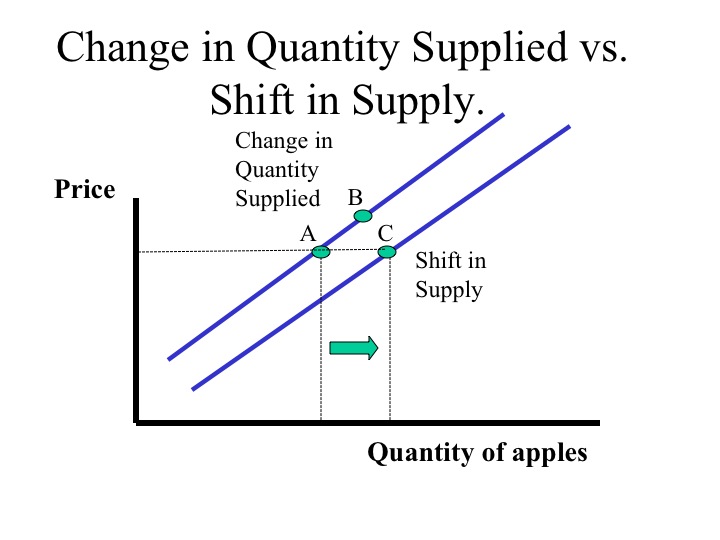

Similar to the demand curve, a movement along the supply bend from betoken A to signal B is chosen a alter in the quantity supplied. Changes along the supply curve are caused by a alter in the cost of the skillful. As the price of the apples increases, producers are willing to supply more apples.

A shift in the supply curve (for example from A to C) is caused past a cistron other than the price of the good and results in a different quantity supplied at each price.

Factors that Shift the Supply Curve

The factors listed beneath will shift the supply curve either out or in.

ane. Resource cost

If the price of rough oil (a resources or input into gasoline production) increases, the quantity supplied of gasoline at each price would decline, shifting the supply curve to the left.

2. Technique of production

If a new method or technique of production is adult, the toll of producing each good declines and producers are willing to supply more at each price - shifting the supply curve to the right.

3. Prices of other goods

If the cost of wheat increases relative to the price of other crops that could be grown on the same land, such as potatoes or corn, then producers will want to grow more wheat, ceteris paribus. By increasing the resources devoted to growing wheat, the supply of other crops volition pass up. Goods that are produced using similar resources are substitutes in product.

Complements in production are goods that are jointly produced. Beefiness cows provide not just steaks and hamburger but as well leather that is used to make belts and shoes. An increase in the toll of steaks will cause an increase in the quantity supplied of steaks and will also cause an increase (or shift correct) in the supply of leather which is a complement in production.

4. Taxes & Subsidies

Taxes and subsidies impact the profitability of producing a good. If businesses have to pay more taxes, the supply curve would shift to the left. On the other hand, if businesses received a subsidy for producing a practiced, they would exist willing to supply more of the good, thus shifting the supply curve to the right.

5. Price Expectations

Expectations about the time to come cost will shift the supply. If sellers anticipate that home values will decrease in the future, they may choose to put their business firm on the market today before the price falls. Unfortunately, these expectations oftentimes become self-fulfilling prophecies, since if many people think values are going downwards and put their house on the market place today, the increase in supply leads to a lower toll.

6. Number of sellers

If more companies get-go to brand motorcycles, the supply of motorcycles would increase. If a motorcycle company goes out of business, the supply of motorcycles would reject, shifting the supply curve to the left.

seven. Supply Shocks

The terminal gene is often out of the hands of the producer. Natural disasters such every bit earthquakes, hurricanes, and floods impact both the production and distribution of goods. While supply shocks are typically negative, there tin be beneficial supply shocks with rains coming at the ideal times in a growing flavor.

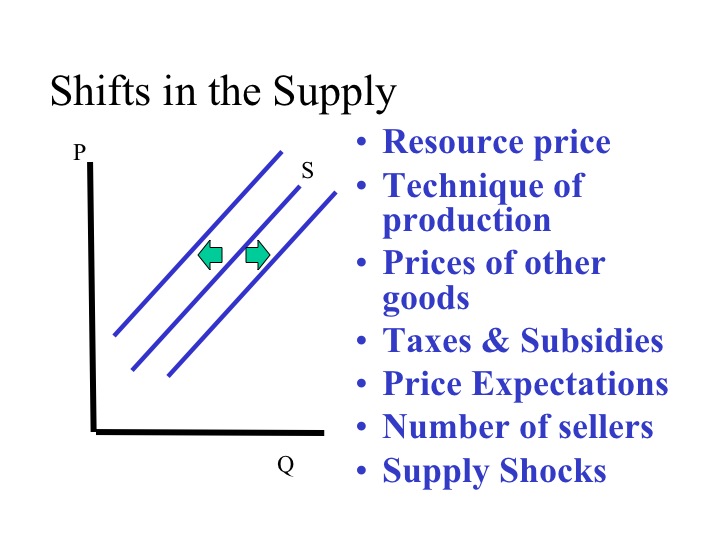

Shifts in the Supply

To epitomize, changes in the price of a expert volition consequence in movements along the supply curve called changes in quantity supplied. A alter in any of the other factors we've discussed (and listed higher up), will shift the supply curve either correct or left. The resulting movements are chosen changes in supply.

Do

Identify how each cistron will shift the supply curve: correct, left, or move along.

| Marketplace | Modify |

| 1. Computers | Cost of retention chips decreases. |

| two. Airline Tickets | Government imposes a new jet fuel tax. |

| 3. Milk | Demand for milk increases. |

| 4. Homes | Potential sellers expect abode prices to turn down in six months. |

| v. Cars | A new engine pattern reduces the price of producing cars. |

| half-dozen. Corn | The cost of wheat (a substitute in production increases in price). |

| 7. Oranges | A freeze in Florida kills 25% of the orangish crop. |

1. Due south-Right two. S-Left 3. Along-Greater Q iv. Due south-Correct v. S-Right 6. S-Left vii. S-Left

Section 03: Equilibrium

Market Equilibrium

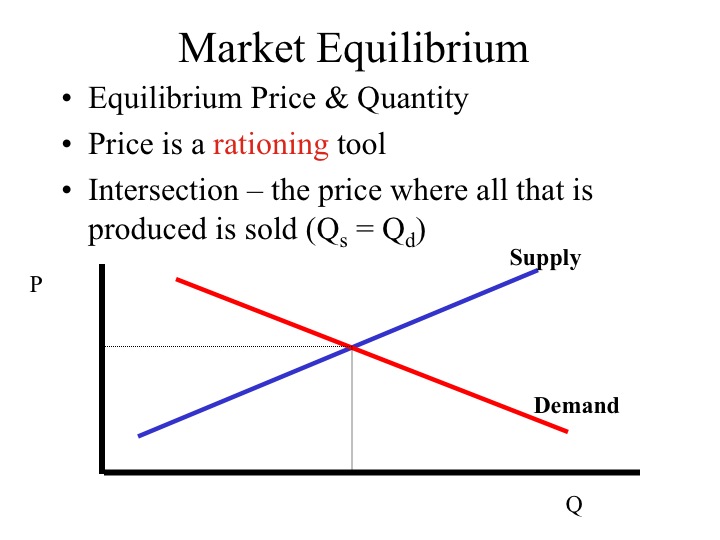

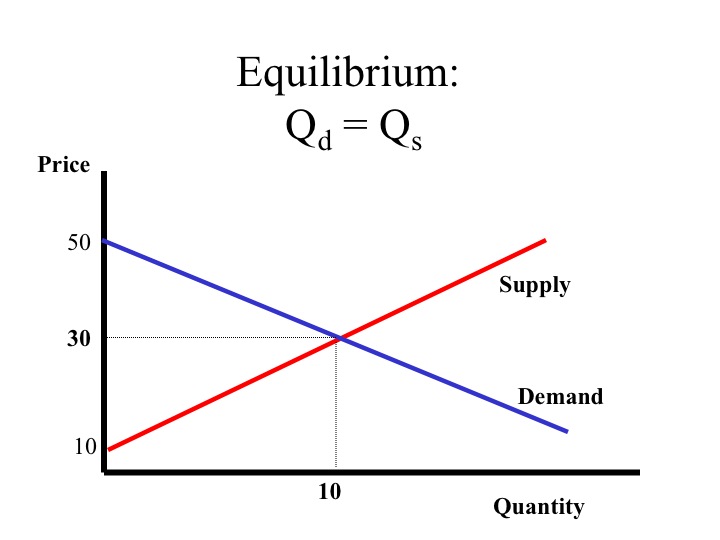

A market brings together those who are willing and able to supply the adept and those who are willing and able to purchase the good. In a competitive market place, where there are many buyers and sellers, the cost of the practiced serves as a rationing machinery. Since the demand curve shows the quantity demanded at each price and the supply bend shows the quantity supplied, the betoken at which the supply curve and demand curve intersect is the point at where the quantity supplied equals the quantity demanded. This is call the market equilibrium.

Consumer Surplus and Producer Surplus

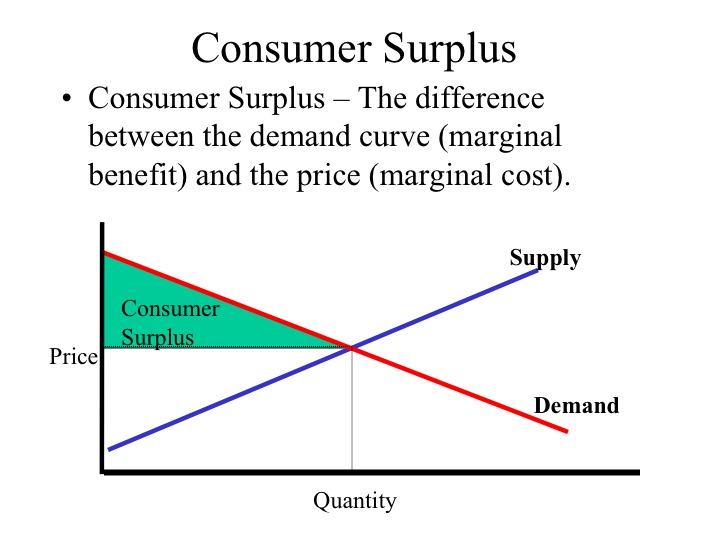

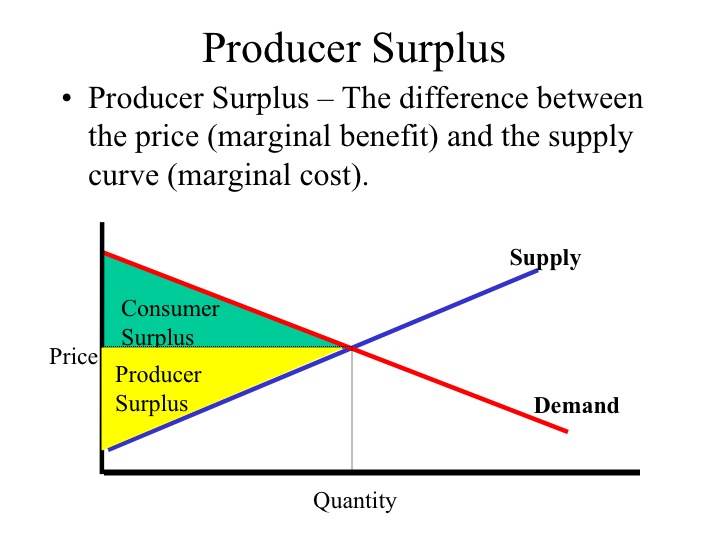

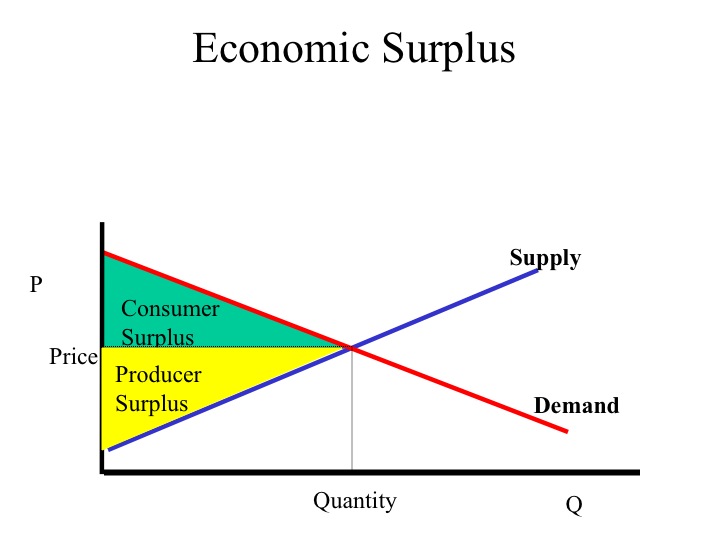

At the final unit purchased, the price the consumer pays (their marginal toll) is equal to what they were willing to pay (the marginal do good). The previous units purchased actually price less than what consumers were willing to pay. This deviation between the demand curve, i.e., what consumers were willing to pay and the price, i.e., what consumers had to pay, is known as the consumer surplus.

The marginal cost of producing a good is represented past the supply curve. The toll received by the sale of the good would be the marginal benefit to the producer, so the difference between the price and the supply curve is the producer surplus, the additional return to producers above what they would require to produce that quantity of goods.

Disequilibrium

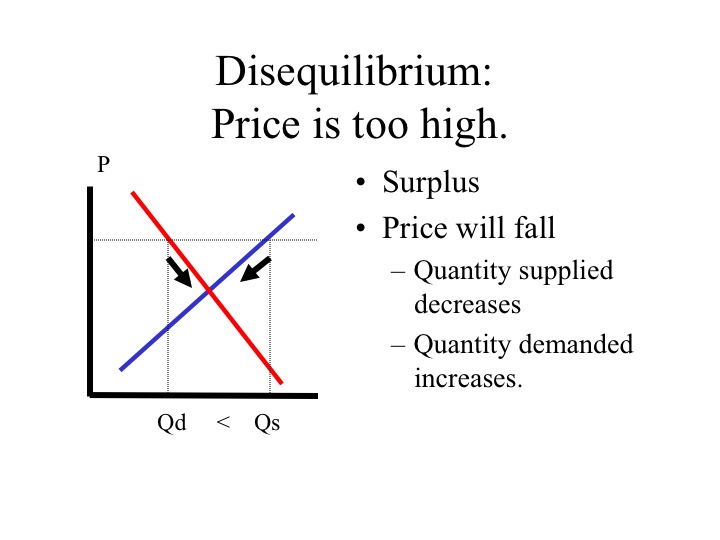

If the market toll is higher up the equilibrium, the quantity supplied volition be greater than the quantity demanded. The resulting surplus in the market will pb producers to cut back on production and lower the cost. As the price falls, the quantity demanded increases since consumers are willing to buy more of the production at the lower cost. In a competitive market, this process continues till the market reaches equilibrium. While a market may not exist in equilibrium, the forces in the market move the market towards equilibrium.

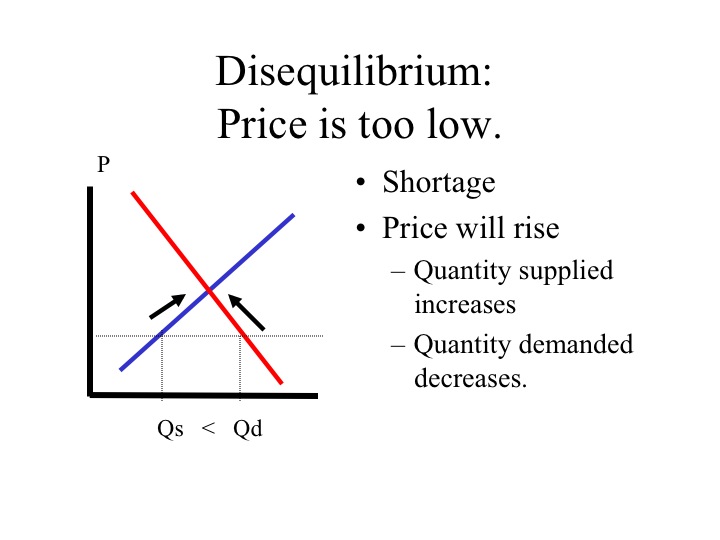

If the market cost is as well depression, consumers are non able to purchase the amount of the product they desire at that price. As a result of this shortage, consumers will offering a higher price for the product. As the cost increases, producers are willing to supply more of the good, only the quantity demanded by consumers will decrease. Forces in the market will proceed to bulldoze the cost up until the quantity supplied equals the quantity demanded.

Shifts in Supply and Demand

The factors of supply and demand decide the equilibrium cost and quantity. As these factors shift, the equilibrium toll and quantity will also change.

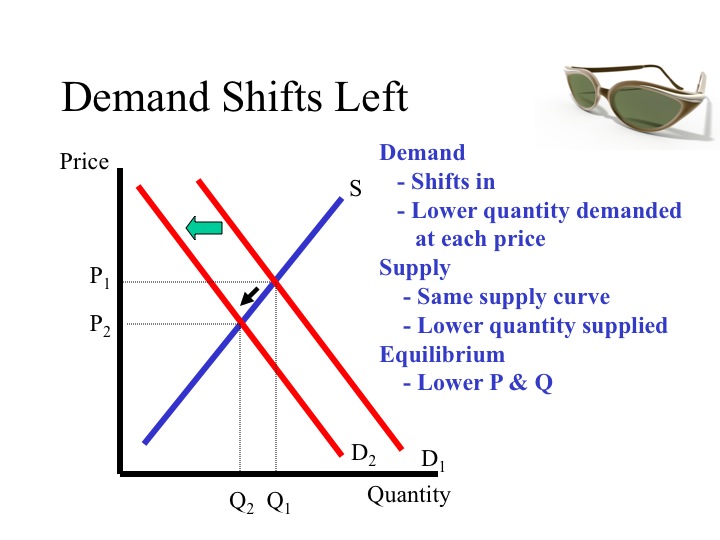

If the demand decreases, for example a particular style of sunglasses becomes less popular, i.eastward., a change a tastes and preferences, the quantity demanded at each toll has decreased. At the current price in that location is at present a surplus in the market place and pressure for the toll to decrease. The new equilibrium volition be at a lower price and lower quantity. Note that the supply curve does non shift but a lower quantity is supplied due to a subtract in the price.

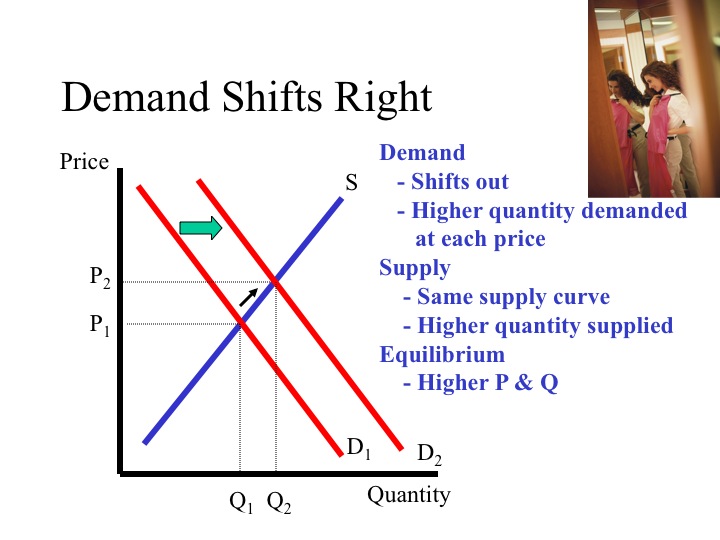

If the demand curve shifts right, there is a greater quantity demanded at each toll, the newly created shortage at the original price will bulldoze the market to a higher equilibrium price and quantity. As the demand curve shifts the change in the equilibrium price and quantity will be in the aforementioned direction, i.due east., both will increase.

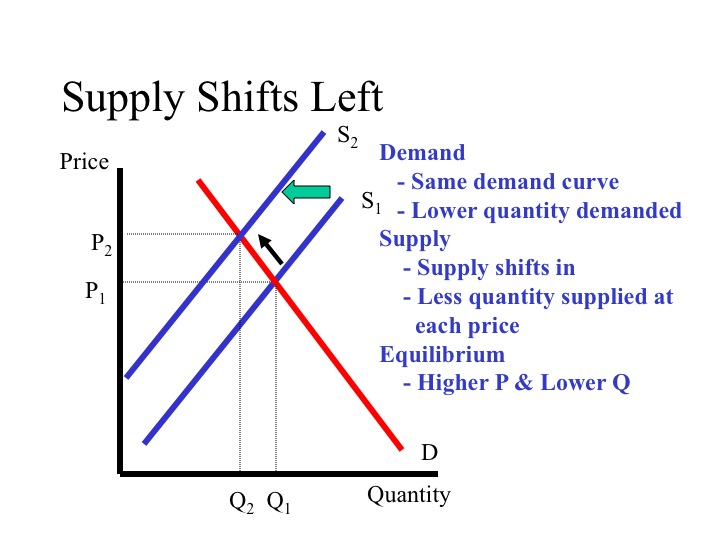

If the supply curve shifts left, say due to an increase in the toll of the resource used to make the product, there is a lower quantity supplied at each price. The upshot will exist an increase in the marketplace equilibrium price but a decrease in the marketplace equilibrium quantity. The increase in price, causes a movement along the demand curve to a lower equilibrium quantity demanded.

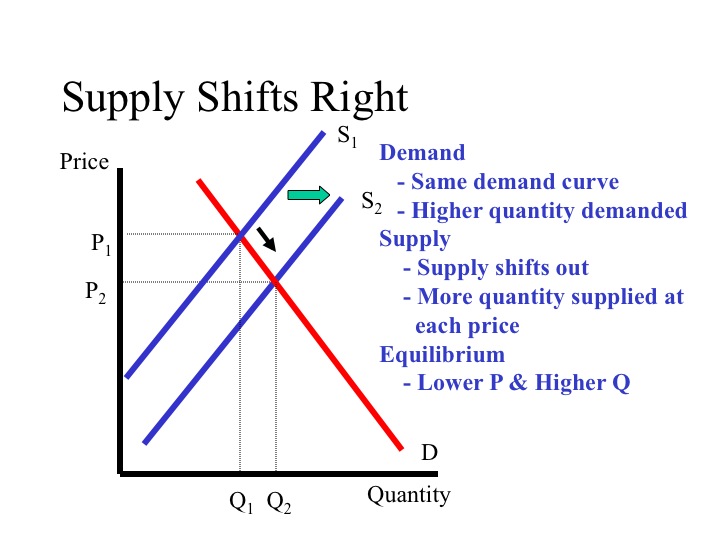

A rightward shift in the supply curve, say from a new production engineering, leads to a lower equilibrium price and a greater quantity. Note that as the supply curve shifts, the change in the equilibrium price and quantity volition be in opposite directions.

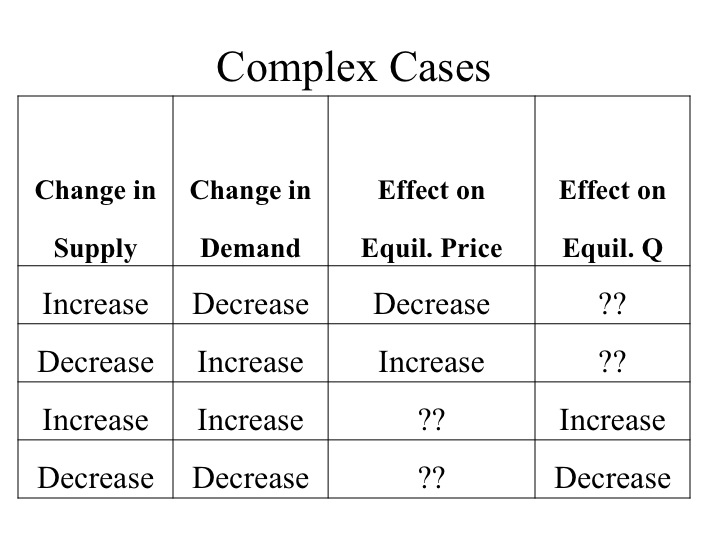

Complex Cases

When demand and supply are changing at the same fourth dimension, the analysis becomes more than complex. In such cases, we are still able to say whether one of the two variables (equilibrium toll or quantity) will increase or subtract, merely we may not be able to say how both will change. When the shifts in demand and supply are driving price or quantity in reverse directions, we are unable to say how one of the two will modify without further information.

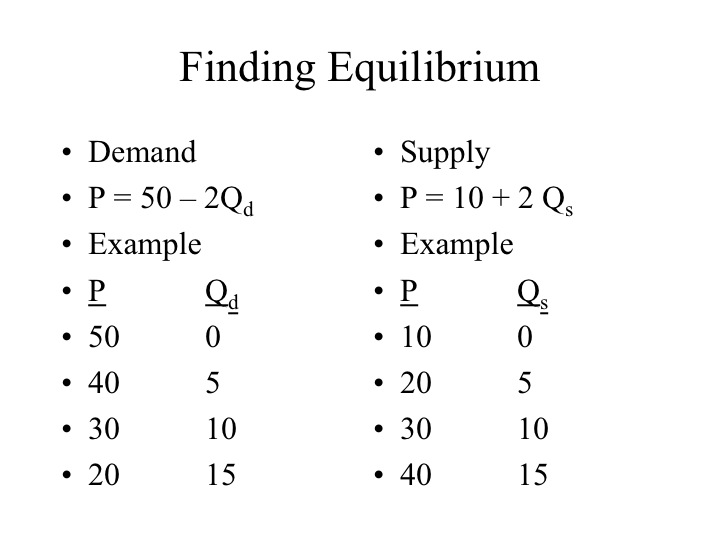

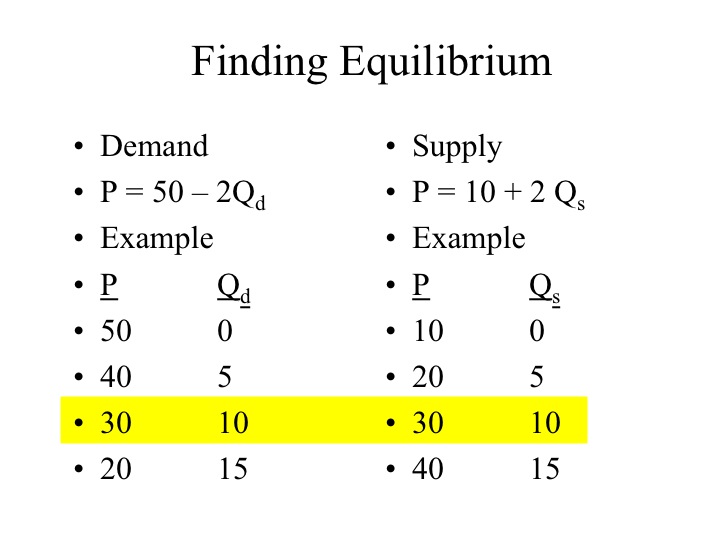

Nosotros are able to find the market equilibrium by analyzing a schedule or table, by graphing the data or algebraically.

Even without graphing the curves, nosotros are able to analyze the table and see that at a toll of $xxx the quantity demanded equals the quantity supplied. This is clearly the equilibrium betoken.

If nosotros graph the curves, we find that at price of thirty dollars, the quantity supplied would exist 10 and the quantity demanded would exist 10, that is, where the supply and demand curves intersect.

The data tin besides exist represented past equations.

P = 50 – 2Qd and P = 10 + 2 Qsouthward

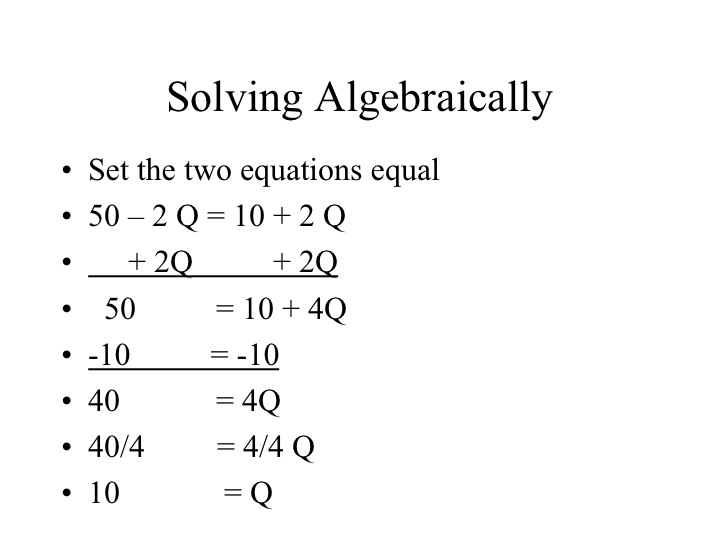

Solving the equations algebraically will likewise enable united states of america to discover the point where the quantity supplied equals the quantity demanded and the price where that will be true. We do this by setting the ii equations equal to each other and solving. The steps for doing this are illustrated below.

Our first stride is to go the Qs together, past adding 2Q to both sides. On the left paw side, the negative 2Q plus 2Q cancel each other out, and on the right side 2 Q plus 2Q gives united states of america 4Q. Our next step is to go the Q by itself. Nosotros can subtract 10 from both sides and are left with 40 = 4Q. The last step is to divide both sides by 4, which leaves us with an equilibrium Quantity of ten.

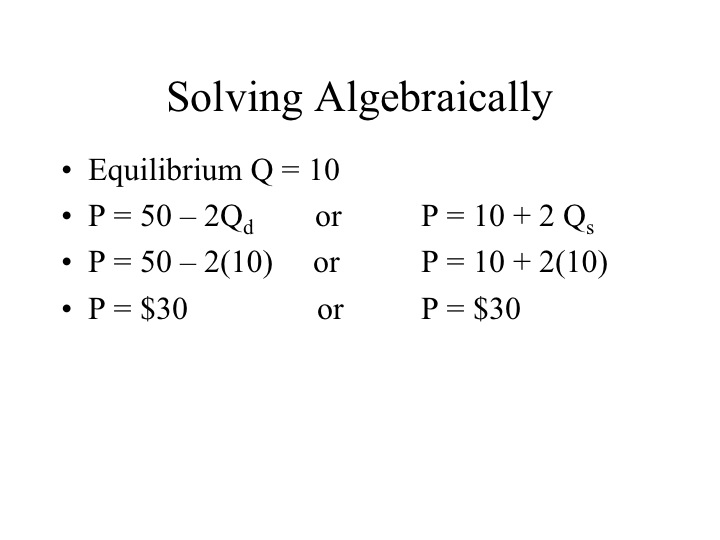

Given an equilibrium quantity of 10, we can plug this value into either the equation we take for supply or demand and find the equilibrium price of $30. Either graphically or algebraically, nosotros end up with the same answer.

Section 04: Market Intervention

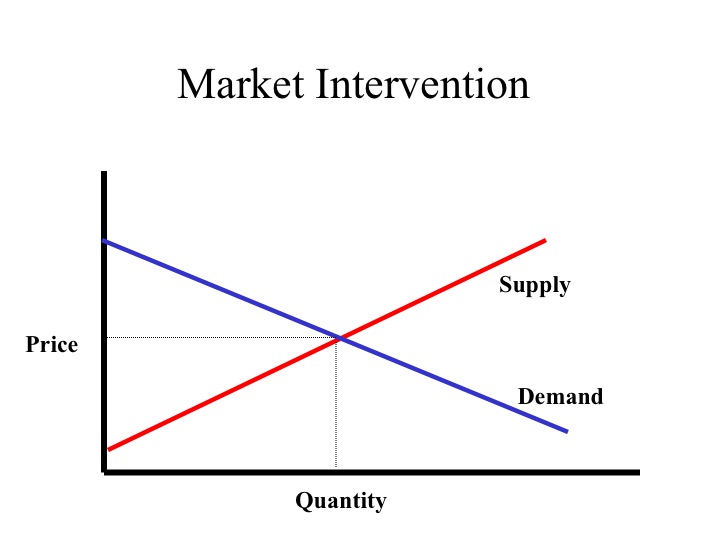

Market Intervention

If a competitive marketplace is complimentary of intervention, marketplace forces will e'er drive the toll and quantity towards the equilibrium. However, at that place are times when government feels a need to intervene in the market and forestall it from reaching equilibrium. While often done with practiced intentions, this intervention often brings about undesirable secondary effects. Market intervention oft comes as either a cost floor or a cost ceiling.

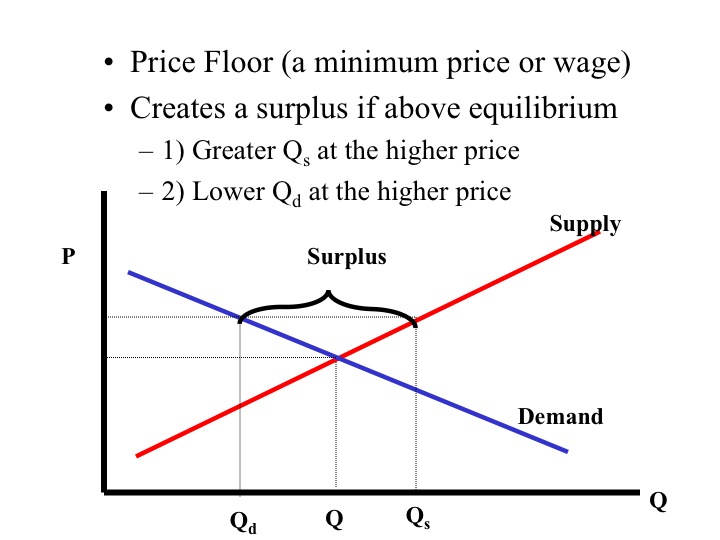

Price Flooring

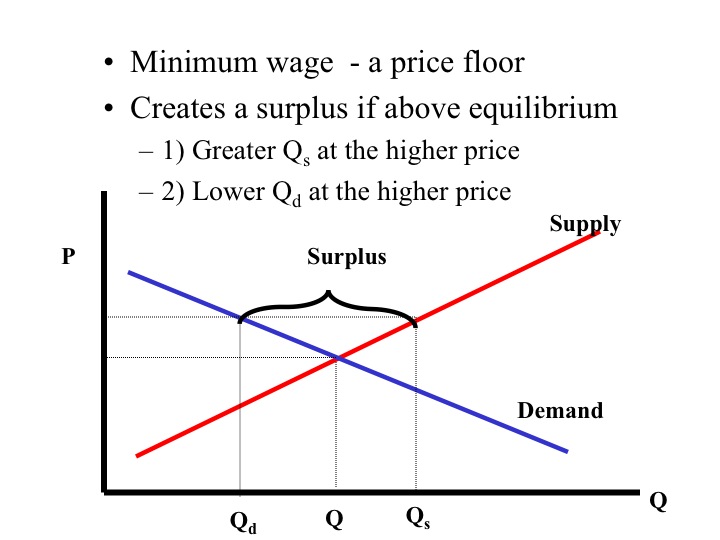

A price flooring sets a minimum price for which the expert may be sold. Price floors are designed to benefit the producers providing them a price greater than the original market equilibrium. To be effective, a toll floor would need to exist above the market equilibrium. At a price above the marketplace equilibrium the quantity supplied will exceed the quantity demanded resulting in a surplus in the marketplace.

For example, the government imposed price floors for certain agronomical commodities, such equally wheat and corn. At a price floor, greater than the market place equilibrium price, producers increase the quantity supplied of the good. Even so, consumers now face a higher price and reduce the quantity demanded. The result of the price floor is a surplus in the market.

Since producers are unable to sell all of their product at the imposed price flooring, they have an incentive to lower the toll but cannot. To maintain the price floor, governments are oft forced to step in and purchase the excess product, which adds an boosted costs to the consumers who are also taxpayers. Thus the consumers suffer from both higher prices only also higher taxes to dispose of the product.

The determination to intervene in the market is a normative decision of policy makers, is the benefit to those receiving a higher wage greater than the added cost to club? Is the do good of having excess food production greater than the additional costs that are incurred due to the market place intervention?

Another example of a price floor is a minimum wage. In the labor market, the workers supply the labor and the businesses need the labor. If a minimum wage is implemented that is above the market equilibrium, some of the individuals who were not willing to work at the original market equilibrium wage are at present willing to work at the higher wage, i.e., at that place is an increase in the quantity of labor supplied. Businesses must now pay their workers more and consequently reduce the quantity of labor demanded. The result is a surplus of labor available at the minimum wage. Due to the regime imposed price floor, price is no longer able to serve as the rationing device and individuals who are willing and able to work at or below the going minimum wage may not be able to find employment.

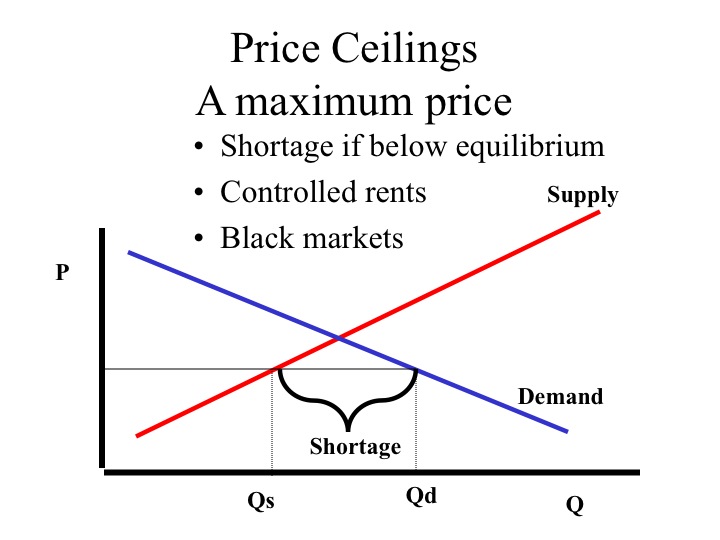

Price Ceilings

Price ceilings are intended to benefit the consumer and set up a maximum cost for which the production may be sold. To be effective, the ceiling price must be below the market equilibrium. Some large metropolitan areas control the cost that tin be charged for apartment rent. The result is that more individuals want to rent apartments given the lower price, just flat owners are not willing to supply as many apartments to the market (i.e., a lower quantity supplied). In many cases when price ceilings are implemented, blackness markets or illegal markets develop that facilitate trade at a price above the gear up regime maximum price.

In a competitive market, the economical surplus which is the combined expanse of the consumer and producer surplus is maximized.

Deadweight Loss

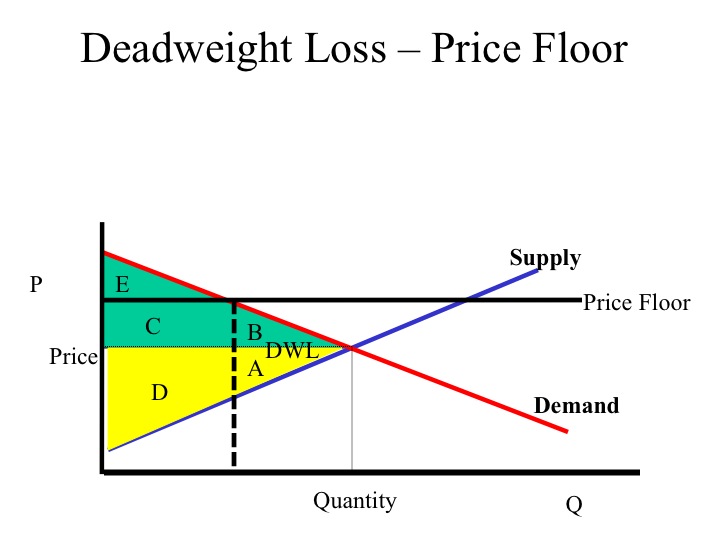

When a price floor is imposed, there is a loss in the economic surplus (Area A and B) known every bit deadweight loss. Since consumer surplus is the area below the demand bend and in a higher place the price, with the toll floor the expanse of consumer surplus is reduced from areas B, C, and Eastward to only surface area E. Producer surplus which is below the toll and to a higher place the supply or marginal cost curve changes from area A and D to D and C.

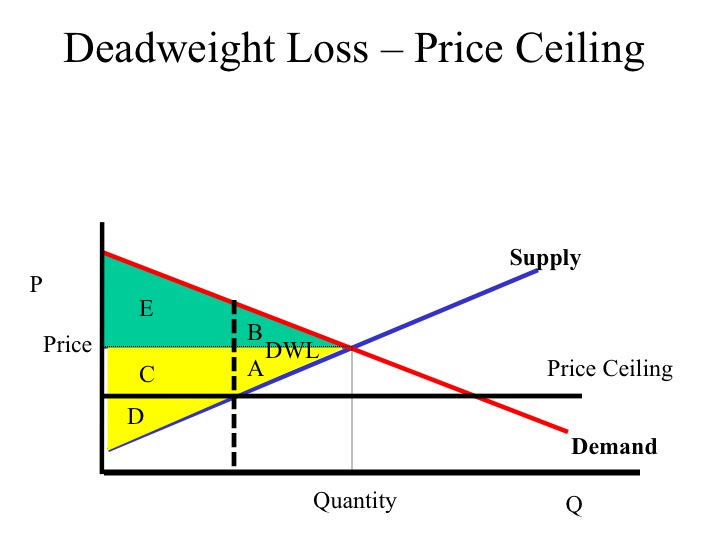

A toll ceiling as well creates a deadweight loss of surface area A and B. The consumer surplus surface area changes from areas E and B to E and C and the producer surplus area is reduced from A, C, and D to only D.

Excise Taxation

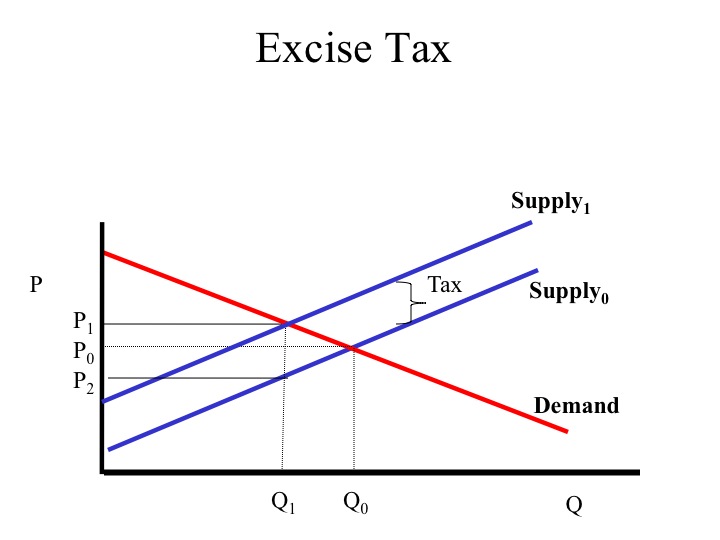

Some other government market place intervention is the imposition of a revenue enhancement or subsidy. An excise tax is a taxation levied on the production or consumption of a product. To consumers, the tax increases the price of the expert purchased moving them along the demand curve to a lower quantity demanded. The vertical distance betwixt the original and new supply curve is the amount of the taxation. Due to the tax, the new equilibrium price (P1) is higher and the equilibrium quantity (Q1) is lower. While the consumer is now paying cost (P1) the producer but receives toll (P2) after paying the taxation.

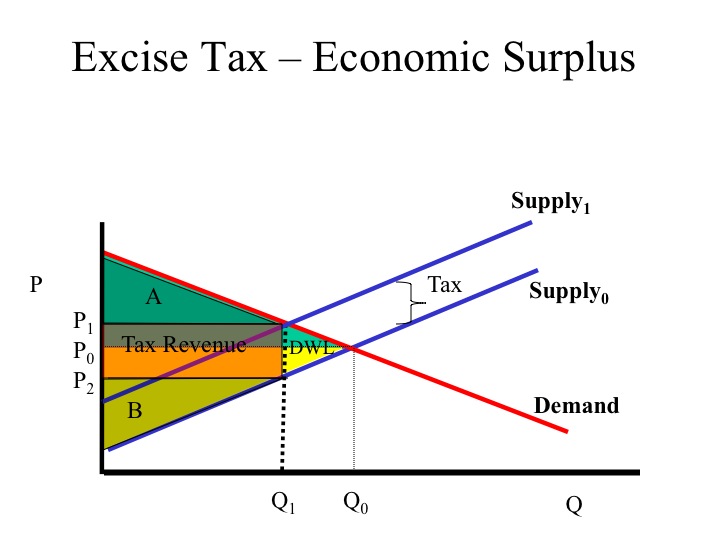

Due to the tax, the expanse of consumer surplus is reduced to area A and producer surplus is reduced to area B. The tax revenue is equal to the revenue enhancement per unit of measurement multiplied past the units sold. The areas of consumer and producer surplus that were to the right of Q1 are lost and make up the deadweight loss.

Source: https://courses.byui.edu/econ_150/econ_150_old_site/lesson_03.htm

0 Response to "It Is Important for a Good Economic Model to Predict Cause and Effect So That It Can:"

Postar um comentário